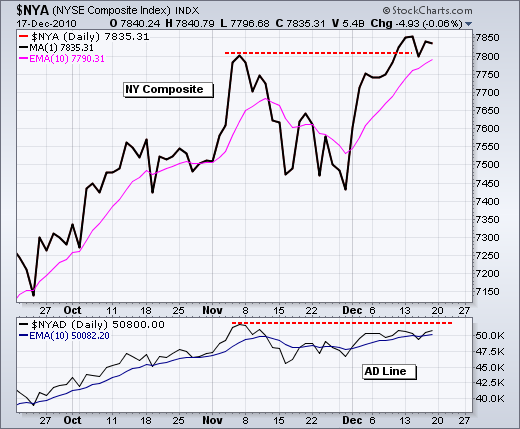

Sentiment readings show excessive bullishness and breadth has been dragging for two weeks, but the uptrends remain in place and seasonality is bullish. The first chart shows the 5-day EMA for the CBOE Total Put/Call Ratio ($CPC) dipping below .75 and nearing its bullish extreme (.70). Prior dips below .70 foreshadowed SPY peaks in January and April. The second chart shows the NY Composite ($NYA) moving above its November high, but the NYSE AD Line remaining below its November high. The AD Line has been flat the last two weeks as Net Advances fail to keep pace with the index. Participation in the advance is waning.

Despite these potential negatives, the trend and seasonal patterns remain bullish. The last two weeks of the year have a bullish bias and we have yet to see any kind of a breakdown on the chart. A small consolidation formed last week and a move above Thursday's high would signal another continuation higher. Key support on the daily chart remains in the 118 area.

On the 60-minute chart, SPY appears to have gapped down on Friday, but this is due to a distribution (ex-dividend). The ETF opened around 124 and then bounced to form a higher low. Overall, a pennant consolidation is taking shape with support around 123.5 and resistance around 125. A break of these levels will provide the next short-term signal. While a support break would be negative, I still see a bigger support zone around 122-123. This, combined with bullish seasonals, could limit the downside.

Key Economic Reports:

Wed - Dec 22 - 07:00 - MBA Mortgage Applications

Wed - Dec 22 - 08:30 - GDP Estimate

Wed - Dec 22 - 10:00 - Existing Home Sales

Wed - Dec 22 - 10:30 - Crude Inventories

Thu - Dec 23 - 08:30 - Personal Income & Spending

Thu - Dec 23 - 08:30 - Durable Orders

Thu - Dec 23 - 08:30 - Initial Claims

Thu - Dec 23 - 09:55 - Michigan Sentiment

Thu - Dec 23 - 10:00 - New Home Sales

Charts of Interest: Tuesday and Thursday in separate post.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More