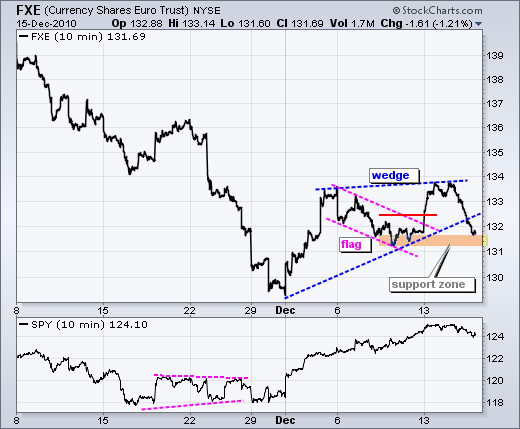

The Euro Currency Trust (FXE) broke wedge support as Forex traders returned to focus on Euro negatives (debt). This does not mean the Dollar has solved its problems. Merely, the focus has shifted back to the Euro. The chart below shows the flag breakout failing after just two days. A strong breakout should hold and the sharp decline back below 132 is quite negative. Final support is based on the early December lows. A break below 131 would open the door to further weakness, which could in turn weigh on European and US equities. Despite the Dollar negatives, the sharp rise in US interest rates is Dollar positive. The second chart shows the 10-year Treasury Yield shooting through 3.5% on Wednesday. Also note that rising interest rates suggests that the Fed will be changing policy in the coming months and that the economy is doing just fine.

There is not much change on the daily chart. SPY remains overbought with a few sentiment indicators showing excessive bullishness and breadth waning. The VIX is trading at low levels in a long-term support zone, the CBOE Total Put/Call Ratio ($CPC) shows excessive bullishness and the NYSE AD Line has yet to exceed its November high. Despite these potential negatives, there are simply no signs of significant selling pressure. With yearend approaching and seasonal patterns largely bullish, stocks could simply remain overbought and hold their uptrends. I am concerned with the sharp rise in interest rates, but stocks seem to be immune so far. At the end of the day, it is the trend that counts the most and there is no denying the current uptrends, both medium-term and short-term. As far as the daily chart is concerned, the November lows hold the key to the uptrend. A move below would forge a lower low and signal the start of a downtrend.

SPY is at its first tests on the 60-minute chart. The ETF declined with a falling flag and RSI moved to 40. This is where RSI should find support in an uptrend. The falling flag is also potentially bullish and a break above 124.6 would trigger a short-term bullish signal. Keep in mind that this is a very short-term signal. Overall, I am leaving key support at 122.

Key Economic Reports:

Thu - Dec 16 - 08:30 - Initial Claims

Thu - Dec 16 - 08:30 - Housing Starts/Permits

Thu - Dec 16 - 10:00 - Philadelphia Fed

Fri - Dec 17 - 10:00 -Leading Indicators

Charts of Interest: Tuesday and Thursday in separate post.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.