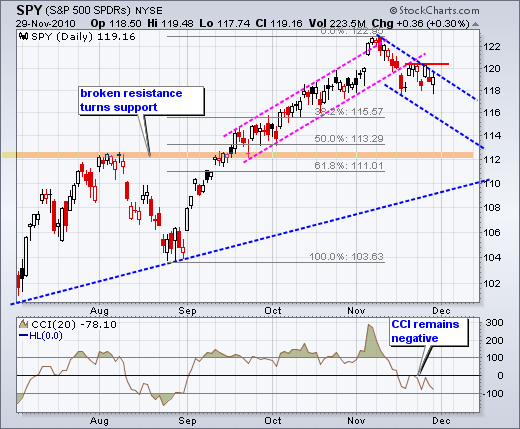

On the daily chart, SPY broke channel support with a gap down in mid November and this break is holding. This short-term support break started a short-term downtrend that is considered a correction within the bigger uptrend. As far as downside targets, we can draw a falling price channel and extend the lower trendline. Also note the 38% retracement around 115.57. CCI continues to hit resistance at zero. A break into positive territory is needed to put momentum back with the bulls.

On the 60-minute chart, SPY has gapped up or down numerous times since the mid November support break. Despite these spirited moves in early trading, the ETF has not been able to follow through and remains range bound the last 2-3 weeks. Even though the early break below triangle support (118) did not hold, the bears still have a short-term edge. First, the mid November support break has yet to be countered with a resistance break at 120.50. Second, short-term breadth remains bearish. Third, RSI continues to hit resistance in the 50-60 zone.

Key Economic Reports:

Tue - Nov 30 - 09:00 - Case-Shiller 20-city Index

Tue - Nov 30 - 09:45 - Chicago PMI

Tue - Nov 30 - 10:00 - Consumer Confidence

Tue - Nov 30 – 20:00 – Bernanke Speaks

Wed - Dec 01 - 07:00 - MBA Mortgage Applications

Wed - Dec 01 - 10:00 - ISM Index

Wed - Dec 01 - 10:00 - Construction Spending

Wed - Dec 01 - 10:30 - Crude Inventories

Wed - Dec 01 - 14:00 - Auto/Truck Sales

Wed - Dec 01 - 14:00 - Beige Book

Thu - Dec 02 - 08:30 - Jobless Claims

Thu – Dec 02 - 10:00 - Pending Home Sales

Fri – Dec 03 - 08:30 - Employment Report

Fri - Dec 03 - 10:00 - Factory Orders

Fri - Dec 03 - 10:00 - ISM Services

Charts: Tuesday and Thursday in separate post.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More