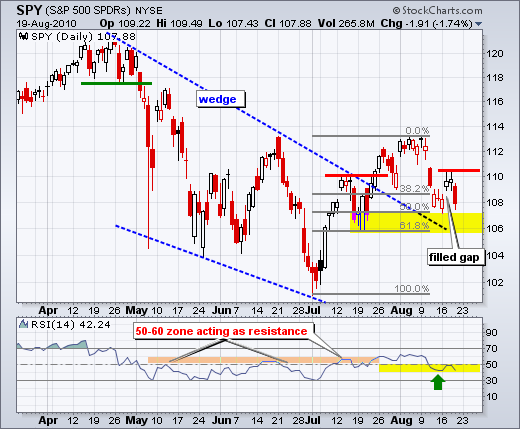

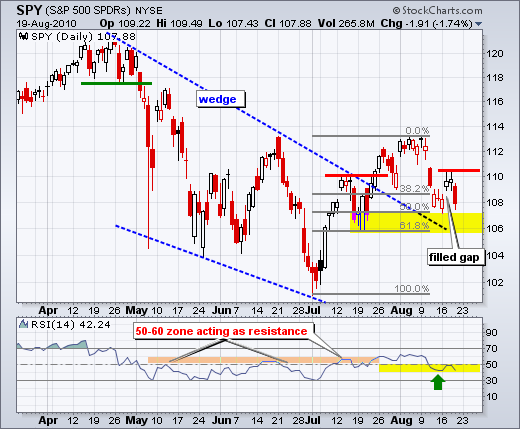

SPY gapped up on Tuesday and then filled that gap with a long red candlestick on Thursday. Some traders apply a three day rule to gaps. A gap that holds three days is valid. One that fails within three days is not. Tuesday's gap has been invalidated. In contrast to Tuesday's gap, the gap down from August 11th continues to hold. In fact, this gap zone marks the lower edge of a resistance zone with this week's reaction highs (~110.5). I am marking 110.5 as an important medium-term resistance level to watch. A recovery and surge above 110.5 would warrant a reassessment the current downtrend.

On the 60-minute chart, resistance in the 110.5-111 area held. Resistance here stems from broken support and the 50-62% retracement of the prior decline (113-107.5). I started highlighting this zone on Monday and it held this week. SPY broke consolidation support at 109 with a sharp decline and broken support here becomes the first resistance level to watch. A surge back above 109 should give the bears a scare. Key resistance remains at 110.5 and RSI resistance remains in the 50-60 zone. A break above both would be enough to turn the short-term trend bullish again.

I remain cautious on my bearish stance for a few reasons. SPY remains near the 50-62% retracement zone (106-107) and RSI remains in the 40-50 zone (daily chart). In addition, the ETF firmed soon after the morning gap and selling pressure dried up quite quickly. Remember, anything can happen. Mr Market has a habit of proving the majority wrong. Right now I would hazard a guess that the majority of traders/investors are bearish. In addition, being bearish is the easy trade right now. Being bullish is the difficult trade. Easy trades also have a habit of not working.

Key Economic Reports:

None on Friday.

Charts of Interest: Tuesday and Thursday.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More