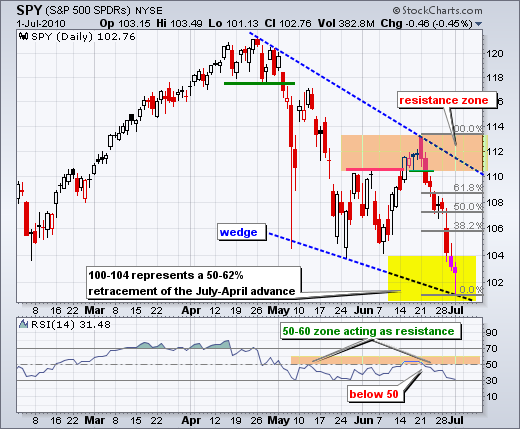

After a 9 day 9.7% decline from high to low, the S&P 500 ETF (SPY) formed a hammer by closing well above its intraday low. I do not think this was the big selling climax, but it does mark an intraday reversal that could put in a short-term low. It all depends on today's reaction to the employment report. Also note that the 100-104 zone represents a 50-62% retracement of the July-April advance, which was the last major move up. The combination of the retracement zone, hammer and oversold conditions make this market ripe for a bounce or consolidation. As far as targets, broken supports and the 38% retracement mark a potential resistance zone in the 104-106 area. A bounce could even extend to the 108 area. However, I think some sort of base building process is needed to repair the technical damage of the last few weeks. This means another pullback or even a test of the hammer low would be in order.

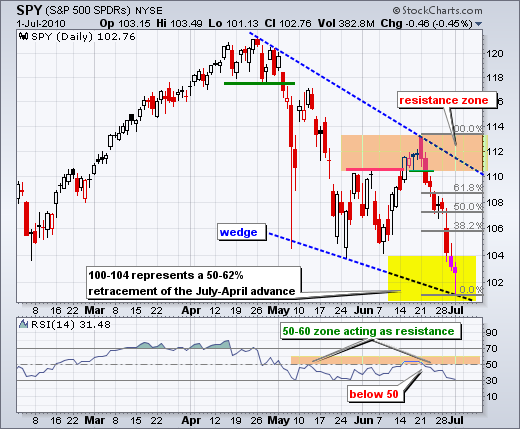

The 30-minute chart focuses on the nine day downtrend. The Monday-Tuesday consolidation marks a resistance zone around 103.5-105. In addition, the trendline covering the entire decline marks resistance around 105. RSI remains in a downtrend and well below the 50-60 zone. Look for SPY to break 105 and RSI to break 60 to reverse the short-term downtrend. I am more inclined to wait for the first surge to judge underlying strength and then wait for a pullback in the form of a falling flag or wedge before considering any trend reversal valid.

It is a busy week on the economic calendar with the employment report due on Friday. The last report (June 4th) sent stocks sharply lower after non-farm payrolls grew less than expected. This report could have an amplified impact because trading may be thin on Friday. Monday, July 5th, is an exchange holiday.

Key Economic Reports:

Jul 02 - 08:30 - Unemployment Report

Jul 02 - 10:00 - Factory Orders

Charts of Interest: None today.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More