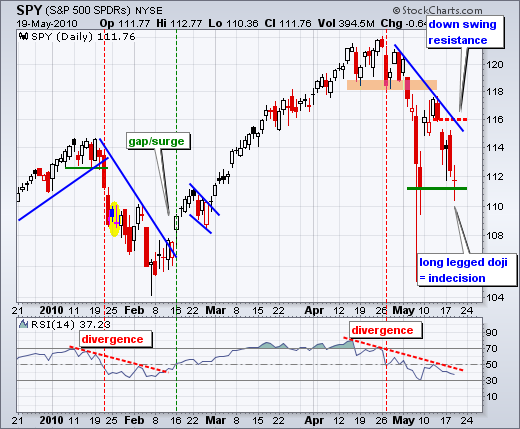

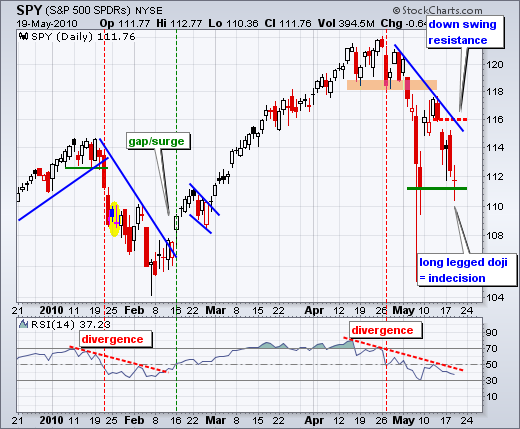

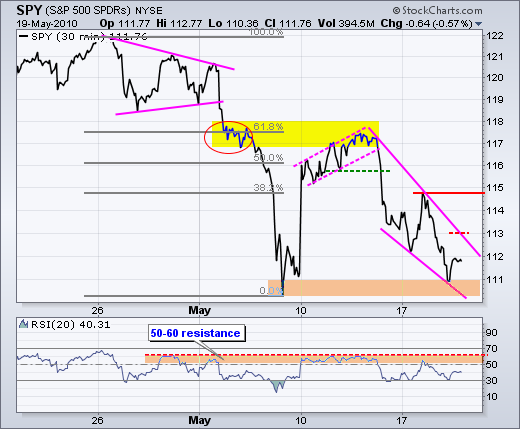

Indecision gripped the market yesterday as the S&P 500 ETF (SPY) formed a classic long legged doji. It is still unclear if these are bull legs or bear legs. The overall trend is down on the daily chart as SPY formed a lower high below 118 and gapped down last Friday. Therefore, the big doji represents a stalemate within a downtrend. This keeps the edge with the bears. Doji can, however, foreshadow reversals. After all, indecision is the first step towards change. At the very least a move above yesterday's high is needed to get a reversal started. Let's just say 113. Look for good volume and participation from the key suspects (finance, technology, consumer discretionary, industrials). Barring such a move, the downtrend rules and we may have to wait for a selling climax to put in a bottom. RSI remains in a downtrend and a break above 50 is needed to reverse momentum.

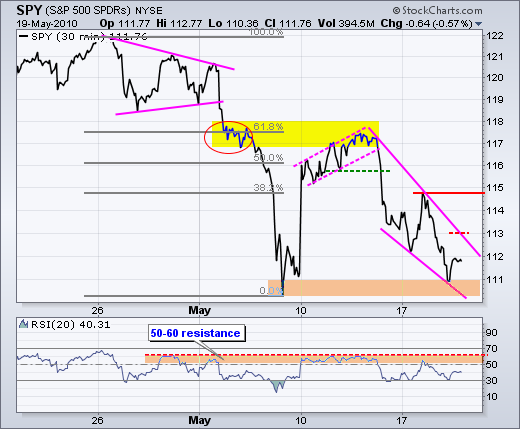

The importance of 113 becomes apparent on the 30-minute chart. The trendline extending down from last week's high marks the first identifiable resistance level here. SPY is currently testing support from the 6-7 May lows as the wedge falls. A trendline break would be the first sign of strength here. My guess is that a solid break will hold and there will be no looking back. Beware of a breakout and then a sudden pullback below 111.80 (failure). RSI remains in a downtrend with resistance in the 50-60 zone. An RSI breakout would confirm an SPY breakout at 113.

Key Economic reports:

Thu - May 20 - 08:30AM - Initial Claims

Thu - May 20 - 10:00AM - Leading Indicators

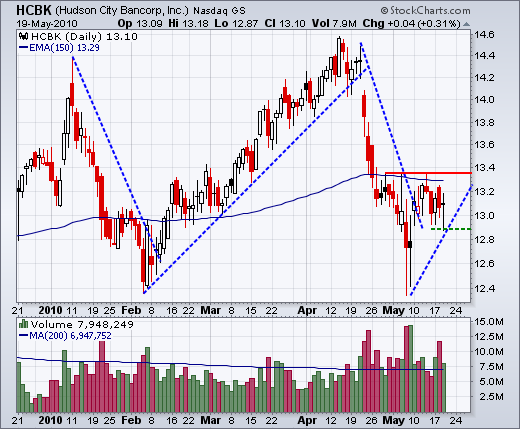

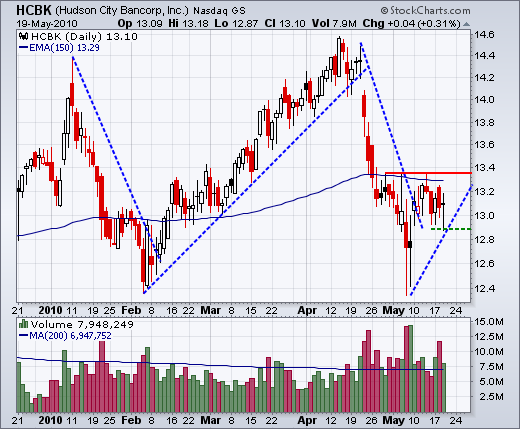

Charts of Interest: ADSK, ARO, AMGN, CAG, HCBK, VRTX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.