I don't usually start with fundamental items, but Friday could be a real doozy. First, the German parliament is scheduled to vote on the Greek bailout. Needless to say, the German public is not too happy about subsidizing early retirement (55) and other Greek benefits. A NO vote would send the European markets into chaos. Why? Because Portugal, Italy, Ireland, Greece and Spain owe 911 billion Euros to French banks and 704 billion Euros to German banks. In essence, the Germany and France are simply bailing out their own banks. A no vote will increase the risk of contagion. France has already voted YES. My gut feeling is that Germany will also vote YES this time. The markets are also concerned because it is taken so long for the Greek bailout. Greek debt is the lowest of the five PIIGS. A second, and more expensive, bailout could take even longer. Second, we have the employment report on Friday before the open. Consensus estimates are for non-farm payrolls to increase 187,000, which would indeed be positive for the economy. Anything below 100,000 would likely be negative for the market. Should the Germans vote YES to the bailout and non-farm payrolls increase 200,000, we could see a sizable advance in stocks and decline in bonds. A NO vote and weak payroll number would be quite negative for stocks and positive for bonds. Grab your hat and hold on tight. It could be a double whammy on Friday.

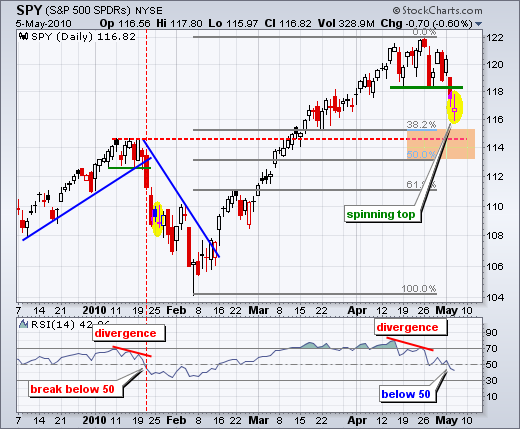

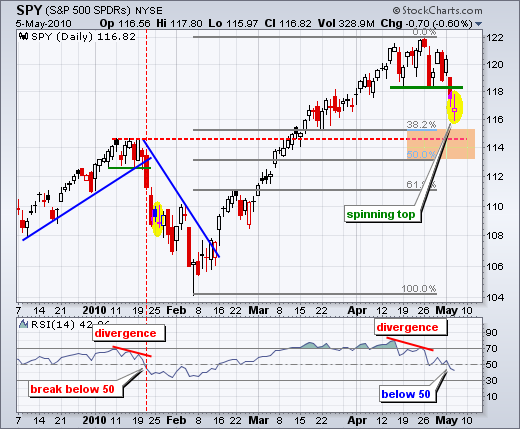

On the daily chart, SPY formed a spinning top candlestick. Such indecisive candlesticks are common after a sharp move. At best, this candlestick marks support and the potential for an oversold bounce. At worst, it signals a mere rest within an ongoing decline. After a support break and sharp three day decline in January, SPY stalled with a couple indecisive candlesticks and then continued lower.

On the daily chart, SPY formed a spinning top candlestick. Such indecisive candlesticks are common after a sharp move. At best, this candlestick marks support and the potential for an oversold bounce. At worst, it signals a mere rest within an ongoing decline. After a support break and sharp three day decline in January, SPY stalled with a couple indecisive candlesticks and then continued lower.

On the 60-minute chart, SPY consolidated in the support zone with a pretty volatile range on Wednesday. Right now, the support break is holding and remains bearish until proven otherwise. The broken support zone around 118.3-119 turns into the first resistance zone to watch on a bounce.

Fri - May 07 - 08:00AM - German Vote

Fri - May 07 - 08:30AM - Employment Report

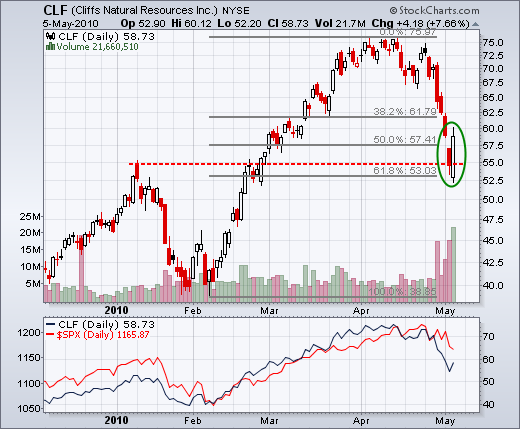

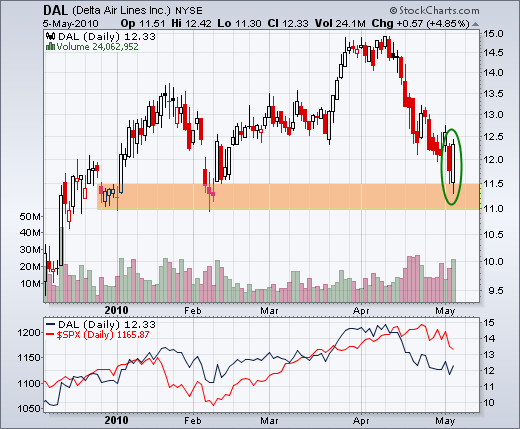

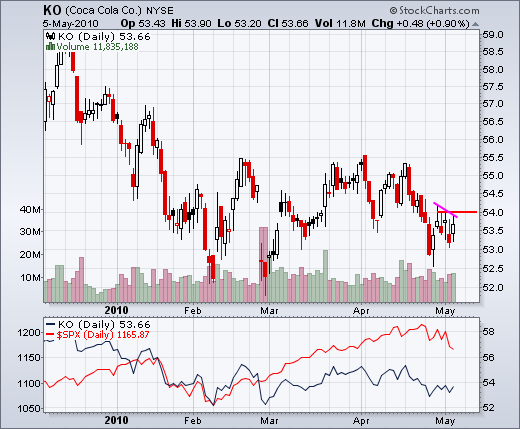

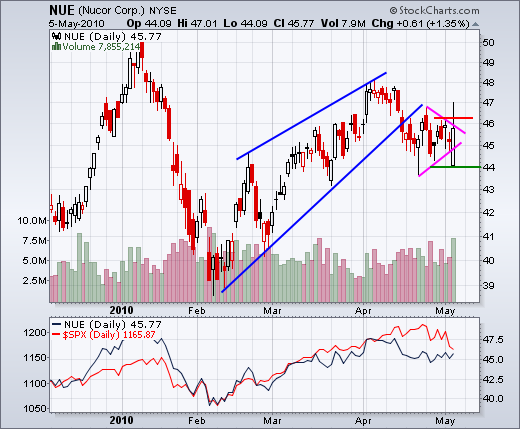

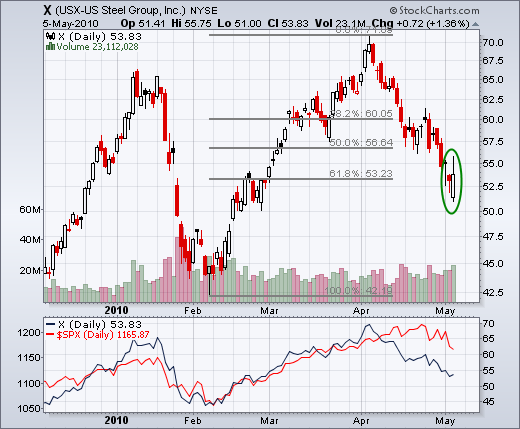

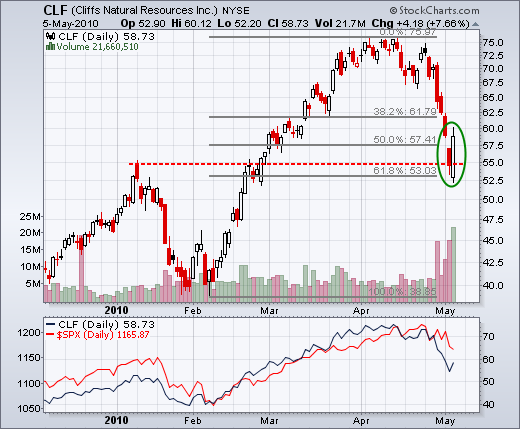

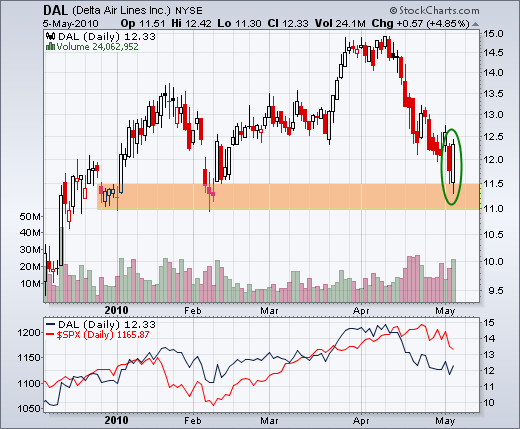

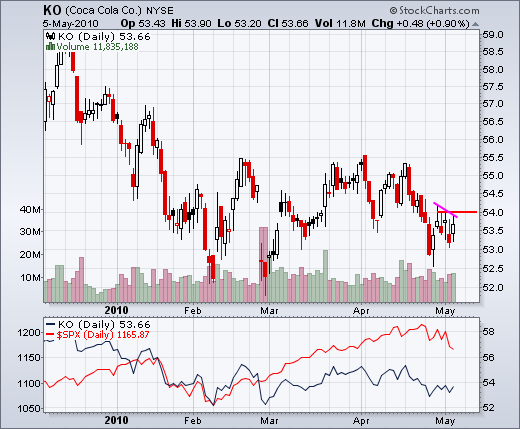

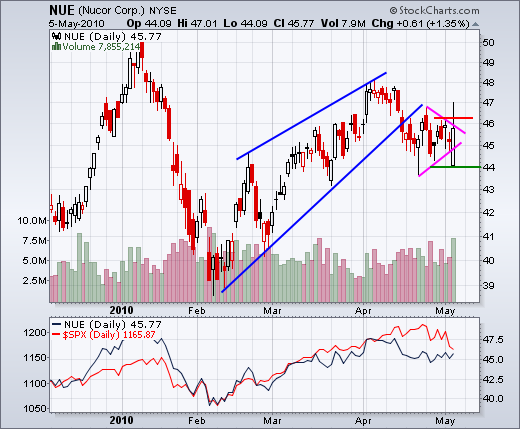

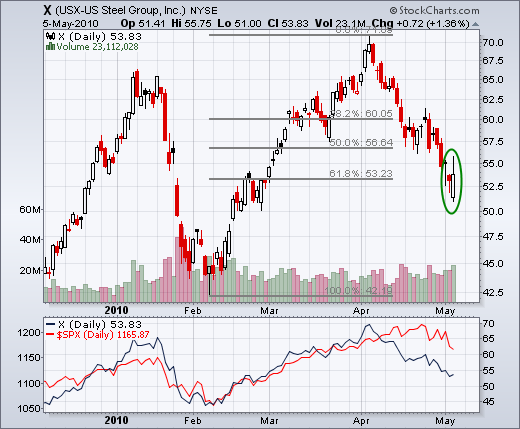

Charts of Interest: CLF, DAL, KO, NUE, STLD, WAG, X

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

Economic reports:

Thu - May 06 - 08:30AM - Initial ClaimsFri - May 07 - 08:00AM - German Vote

Fri - May 07 - 08:30AM - Employment Report

Charts of Interest: CLF, DAL, KO, NUE, STLD, WAG, X

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More