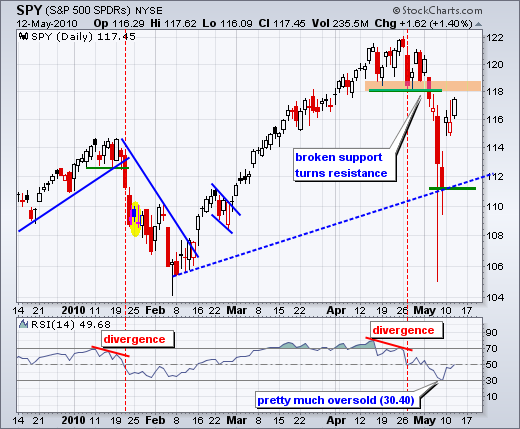

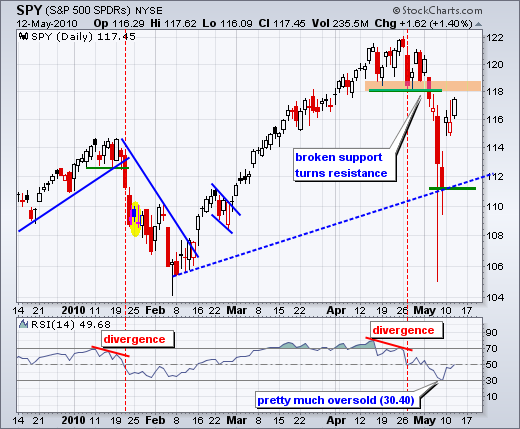

After some indecision around 116, the bulls reasserted themselves and pushed SPY another 1.40% higher on Wednesday. Monday's gap is holding and the cup remains half full. Over the last three days, SPY is up 5.56%, QQQQ is up 7.07% and IWM is up 9.58%. Of course, the prior declines were deeper with SPY down ~8.5, QQQQ down ~10% and IWM down ~12% in 10 days. A bigger advance is required to recoup a loss. For example, it takes an 11.11% advance to recoup a 10% loss. Nevertheless, we have seen strong moves all around with small-caps leading the way the last three days. Small-caps leadership is a good sign because it shows a healthy risk appetite. Short-term, I am concerned because the market is already getting overbought. In addition, resistance from broken support is near on the daily chart and RSI is at 50.

Resistance is also coming into play on the 30-minute chart. SPY has resistance around 117-118 from last week's consolidation and the 62% retracement mark. After an opening gap on Monday morning, the ETF has been working its way higher the last few days with a rising channel. The bulls are in good shape as long as this channel rises. Look for a move below 115.50 to break channel support and start a pullback. Because the bigger trend remains up, I would expect just a pullback, not a full fledged breakdown or move below last week's lows.

Key Economic reports:

Thu - May 13 - 08:30AM - Initial Claims

Fri - May 14 - 08:30AM - Retail Sales

Fri - May 14 - 09:15AM - Industrial Production

Fri - May 14 - 09:55AM - Mich Sentiment

Charts of Interest: AA, AKS, CMCSA, DIS, GME, KO, PFE

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

Key Economic reports:

Thu - May 13 - 08:30AM - Initial Claims

Fri - May 14 - 08:30AM - Retail Sales

Fri - May 14 - 09:15AM - Industrial Production

Fri - May 14 - 09:55AM - Mich Sentiment

Charts of Interest: AA, AKS, CMCSA, DIS, GME, KO, PFE

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More