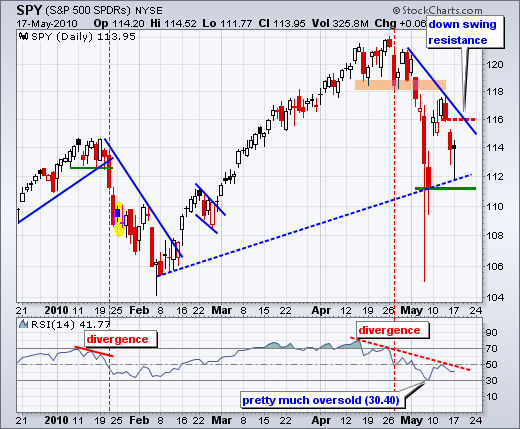

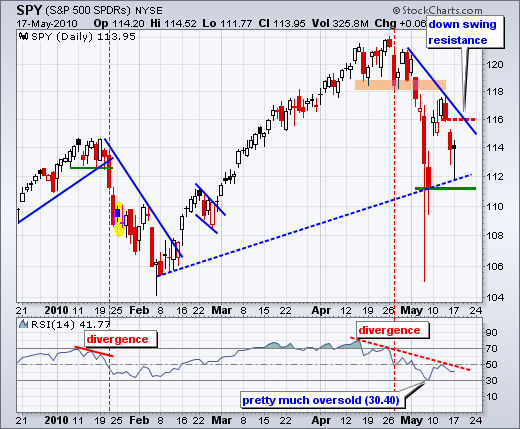

SPY continued lower on Monday morning with a dip below 112. This put SPY close to the 7-May close at 111.26 and within the 7-May candlestick body. After dipping below 112 in the late morning, buyers stepped into the market and pushed SPY to 113.95 on the close. Not a bad recovery. As a result, a number of hammers and hammer-esque candlesticks formed on Monday. I think it is important to remember that the weekly trend remains up with higher highs in January-April and higher lows in February and May (so far). With the bigger trend up, declines that hold above the prior low (February) are deemed corrections within a bigger uptrend. With last week's failure at broken support and Friday's gap down, this correction remains in play. In other words, the 3-4 week swing/trend is down. A move above 116.5 would break the late April trendline and fill Friday's gap. A move on good volume and breadth would forge a valid breakout. RSI met resistance at 50 and is still trending lower. Look for a break above 50 to turn momentum bullish again.

On the 30-minute chart, SPY sank below 113 and the 62% retracement mark and then rebounded back with a pretty good afternoon rally. This little dip was a mean trick by the market makers to scare the Fibonacci enthusiasts. All kidding aside, we are in a volatile period where overshoots are the norm, not the exception. In addition, Fibonacci Retracements are potential reversal zones, not hard reversal points. A steep wedge formed over the last few days and SPY broke the upper trendline on Monday afternoon. Further strength above 114.5 would break the Monday morning high. RSI is entering the 50-60 zone, which provided resistance since late April. A break above 50 would be positive for short-term momentum.

Key Economic reports:

Tue - May 18 - 08:30AM - Housing Starts

Tue - May 18 - 08:30AM - Producer Price Index

Wed - May 19 - 08:30AM - Consumer Price Index

Wed - May 19 - 10:30AM - Crude Inventories

Thu - May 20 - 08:30AM - Initial Claims

Thu - May 20 - 10:00AM - Leading Indicators

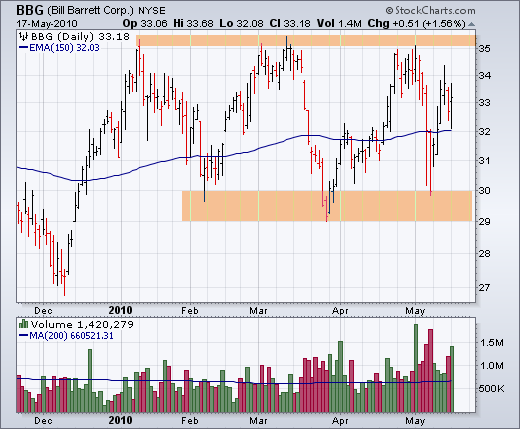

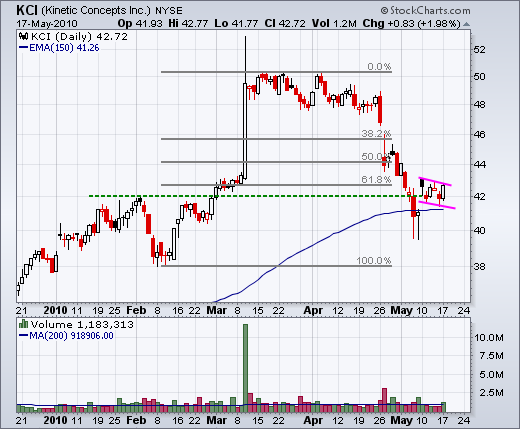

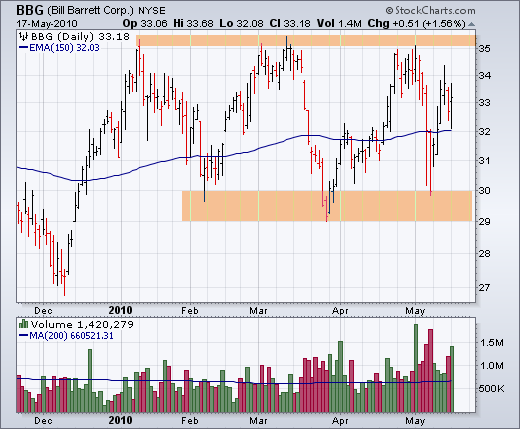

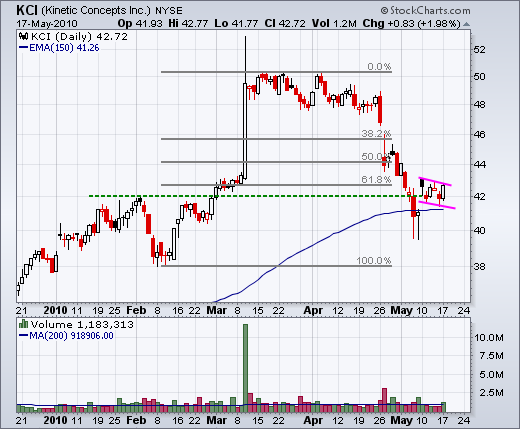

Charts of Interest: BBG, BLUD, CXW, FCN, KCI, ROL, VRTX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

Key Economic reports:

Tue - May 18 - 08:30AM - Housing Starts

Tue - May 18 - 08:30AM - Producer Price Index

Wed - May 19 - 08:30AM - Consumer Price Index

Wed - May 19 - 10:30AM - Crude Inventories

Thu - May 20 - 08:30AM - Initial Claims

Thu - May 20 - 10:00AM - Leading Indicators

Charts of Interest: BBG, BLUD, CXW, FCN, KCI, ROL, VRTX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More