While small-cap leadership is generally bullish and shows an increase in risk appetite, it also reflects an increase in bullish sentiment. This is confirmed by Mark Hulbert of CBSMarketWatch.com:

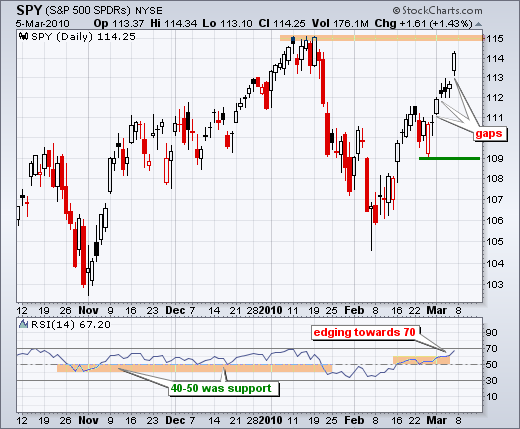

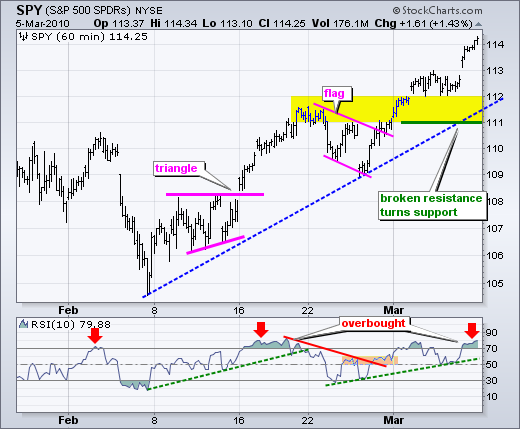

Sentiment indicators are hard to use for timing. Excessive bullishness warns that the stock market may be getting too frothy, but we need to use the charts for actual signals. Last week, SPY gapped up three times: Monday, Tuesday, Friday. All three gaps held, which is impressive. The ability to hold these gaps shows strength, not weakness. Look for a move below 112 to fill the last two gaps. Key support remains at 109 for now.Based on the several hundred investment advisers I track, I'd have to say that bullish sentiment is approaching dangerously high levels. Consider the Hulbert Stock Newsletter Sentiment Index (HSNSI), which represents the average recommended stock market exposure among a subset of short term stock market timers tracked by the Hulbert Financial Digest. It currently stands at 62.8%, up from 13.8% just one month ago. That's an awfully big jump for so short a period of time, especially considering that the Dow Jones Industrial Average rose a modest 4.4% over this period. Also worrying is that, with but one exception, the HSNSI is now at its highest level since early 2007, more than three years ago. That one exception, when the HSNSI was higher than it is now, came in early January, two months ago. Soon thereafter, of course, the market entered into its January-February correction, during which the Dow declined by nearly 8%.

Potential market moving reports this week:

Wed: Mar 10 - 10:30 - Crude Inventories

Thu: Mar 11 - 08:30 - Initial Claims

Fri: Mar 12 - 08:30 - Retail Sales

Fri: Mar 12 - 09:55 - Michigan Sentiment

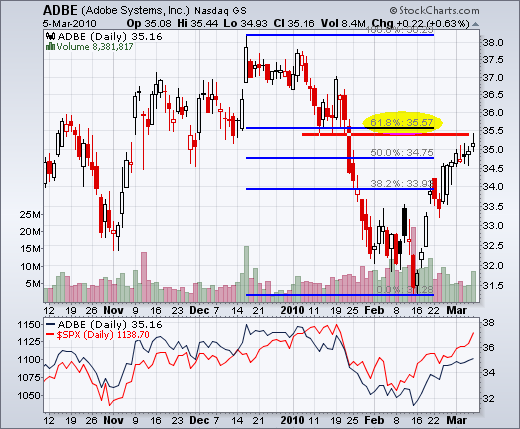

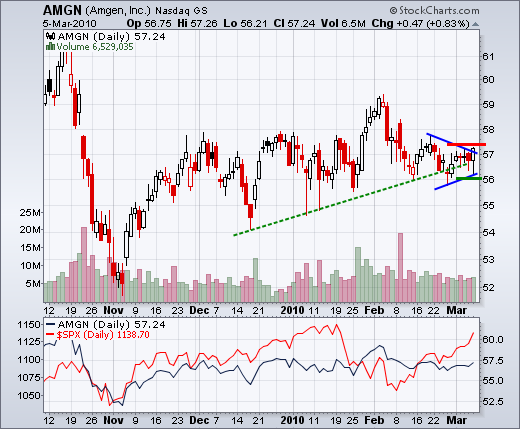

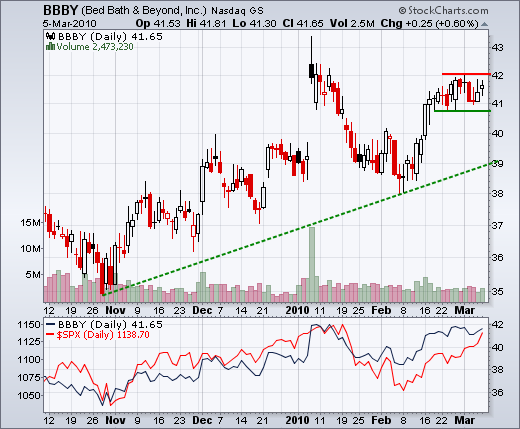

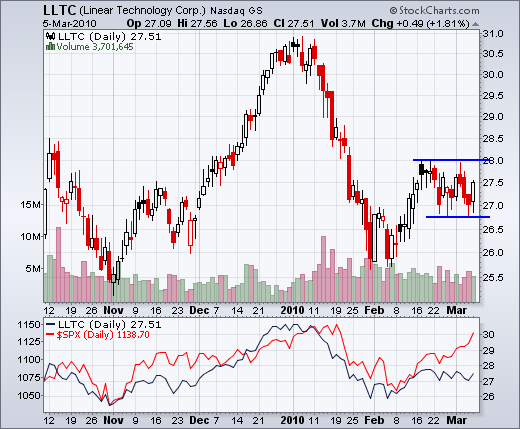

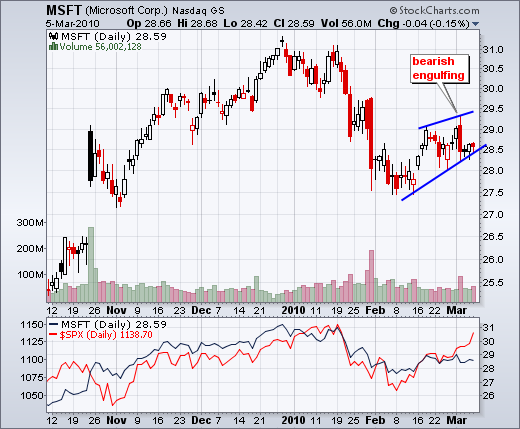

Charts of Interest: ADBE, AMGN, BBBY, LLTC, MBI, MSFT, STT