Even after a high-volume bearish engulfing on quadruple witching Friday and weak open on Monday, the bulls refused to give up the trend and pushed stocks higher immediately after the open. One day does not a trend change make. Selling pressure has been very limited since the early February low. There are only three filled red candlesticks, which happens when the close is below open and prior close. The two hollow red candlesticks count as buying days because SPY rallied after a weak open. These occur when the close above the open, but below the prior close. With Monday's long white candlestick, SPY established short-term support just above 115.

The 60-minute chart shows the entire advance from early February to late March. It fits nicely within a Raff Regression Channel. The thicker blue line at the end is an extension of the lower trendline. There is a support zone in the 115-116 area. I am marking key support at 115 and a break below this level would reverse the short-term uptrend. After a six week advance, there is likely to be some sort of bounce after the first significant pullback. Therefore, more patient traders may want to wait for this decisive decline and then look for an oversold bounce that retraces around 50%. The early bird gets the worm, but the second mouse gets the cheese. The first one was caught in the trap. RSI continues to hold support in the 40-50 zone. A move below 40 is likely to accompany a break below 115.

Tue - Mar 23 10:00 Existing Home Sales

Wed - Mar 24 08:30 Durable Orders

Wed - Mar 24 10:00 New Home Sales

Wed - Mar 24 10:30 Crude Inventories

Thu - Mar 25 08:30 Initial Claims

Thu - Mar 25 08:30 Natural Gas Inventories

Fri - Mar 26 08:30 GDP

Fri - Mar 26 09:55 Michigan Sentiment

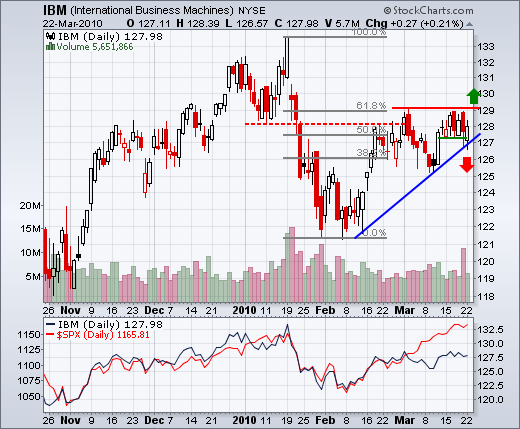

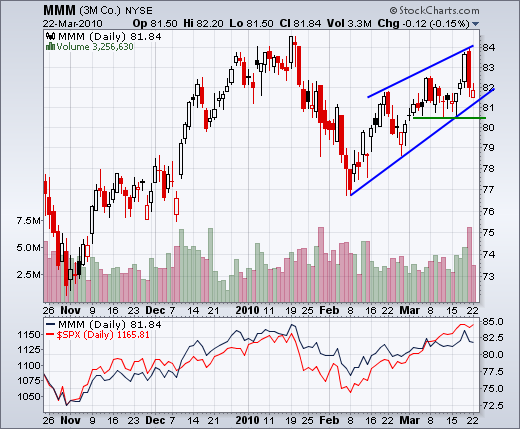

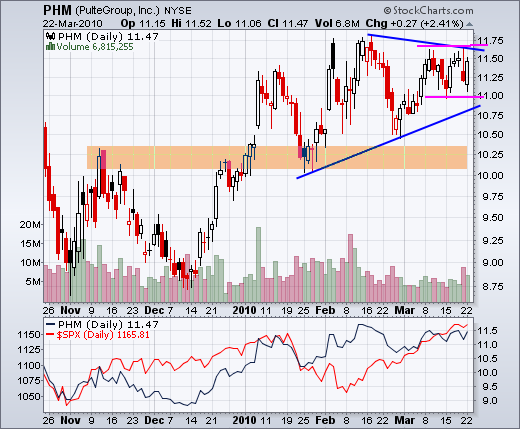

Charts of Interest: IBM, MMM, MON, PFE, PHM, WDC

(click on image to see a live chart)

Charts of interest are just that: charts of interest. We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More