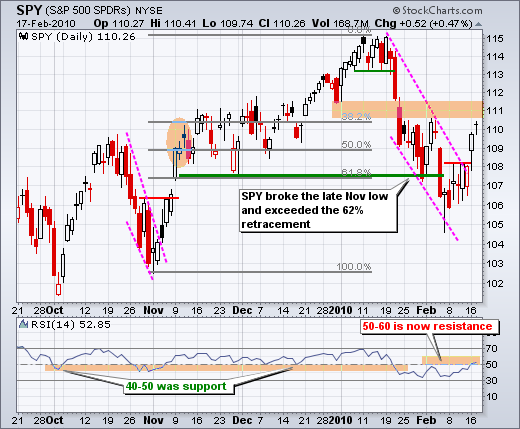

The bounce over the last seven days does not look that strong and resistance is nigh. First, I pointed out mixed breadth and weak volume on Wednesday. Second, individual days show more indecision than strength. After plunging from 115 to 105 (high to low), SPY was oversold in early February and formed a hammer. This hammer marked the short-term low as the ETF bounced over the next seven days (four up, three down). Of these seven days, only two featured white candlesticks with sustained gains. The other five candlesticks either closed lower or showed indecision, like Wednesday's doji. Indecision just below resistance suggests that this bounce could be running out of steam. Also notice that RSI moved into the 50-60 zone, which marks resistance in an overall downtrend. In contrast, note that the 40-50 zone marked RSI support in an overall uptrend. The key is my assumption that the medium-term trend is now down. If my assumption is wrong and the medium-term trend is still up, RSI would likely move through 50-60 resistance.

On the 60-minute chart, SPY hit a potential resistance zone in the 110-111 area as RSI became overbought. This zone stems from the late January and early February highs as well as the 50-62% retracements. Note that SPY has retraced 50% of the January-February decline and is now trading in the middle of its 2010 range. SPY is also short-term overbought after a ~5.5% run from the 5-Feb low to the 17-Feb high (104.58 to 110.41). The bottom indicator window shows plain vanilla RSI (14-period). The indicator has become overbought for the fourth time this year. RSI is both overbought and bullish as long as it holds above 70. A move below 70 would be the first sign of weakening momentum. A break below 50 would turn short-term momentum bearish. The red dotted lines show prior setups.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More