There is no change in the short-term or medium-term trends for the S&P 500 ETF (SPY). The Fed meeting ends today with an announcement expected at 2:15 PM ET. We can expect some volatile swings just before and after the announcement with volatility subsiding around 3PM. It is possible that the direction established after 3PM holds for a few days. On the daily chart, SPY closed above 111 for three days in a row and has been up three of the last four days. However, post-open price action has been rather choppy. Notice that the last four candlesticks show little change from open to close and rather tight high-low ranges. In fact, Monday's percentage high-low range was the lowest of the year ((high - low)/close). Bollinger Band Width is also trading at its lowest level of the year. One could certainly call this a dull market. There is an old Wall Street adage: never short a dull market. Also consider that the medium-term and short-term trends are up and seasonality favors the bulls over the next 2-3 weeks.

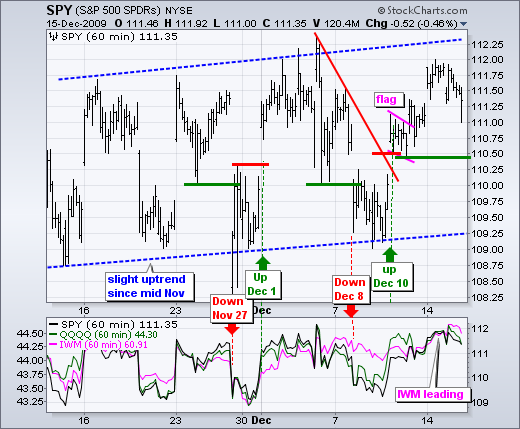

On the 60-minute chart, SPY is meeting resistance in a familiar area (111-112). Three prior bounces failed in this area. With another gap up and surge above 111, we are currently witnessing the fourth attempt to break free. Despite resistance, there is a slight upward price bias since mid November. Within this slow rise, I am watching the gap breakout and the flag low for support. A move below 110.4 would break both and reverse the upswing within this trading range.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More