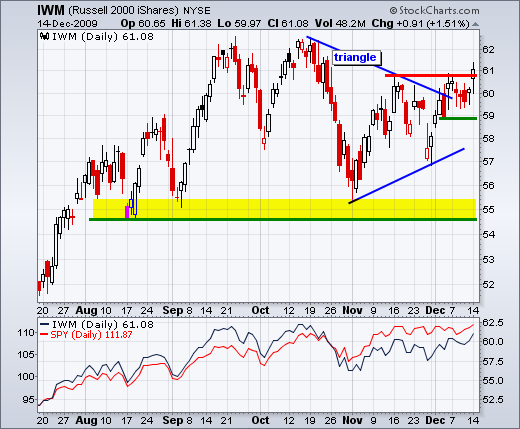

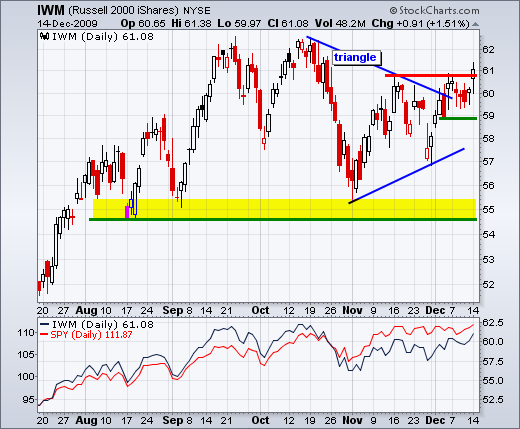

I first wrote about the Russell 2000 ETF (IWM) and the January effect on December 1st. To recap: the January effect is the historical tendency for small-caps to outperform large-caps from mid December to end January. IWM was firming in the 57-58 area on December 1st and I drew a tentative trendline extending up from the early November low. IWM subsequently surged in early December and broke above its mid November high yesterday. IWM appears headed for a resistance challenge around 62-63. A break below 58.9 would call for a reassessment.

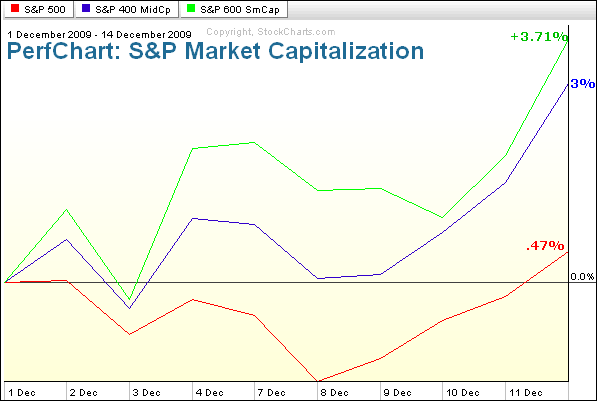

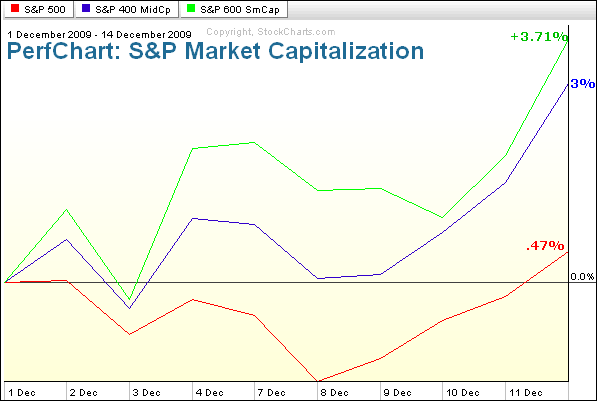

Even though IWM remains below its Sep-Oct highs, the ETF and small-caps are showing relative strength in December. The S&P Market Capitalization Perfchart shows the S&P 600 SmallCap Index ($SML) easily outperforming the S&P 500 since December 1st. Midcaps are also outperforming handily. It appears that the January effect started even earlier this year. This means it could end earlier too.

*****************************************************************

*****************************************************************

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More