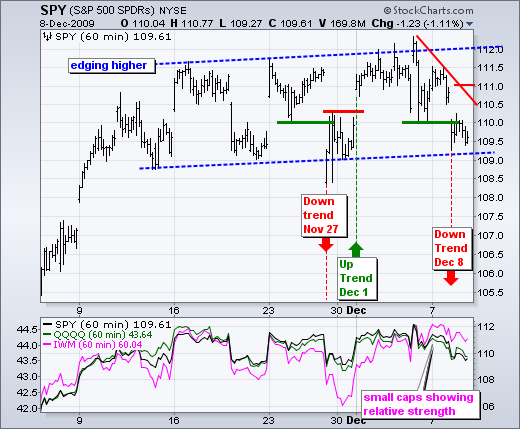

The 60-minute chart shows SPY edging higher over the last four weeks. I elected to draw through the opening low on November 27th, which was the Dubai reaction on the Friday after Thanksgiving. Even though this range is quite choppy, SPY has been edging up with higher highs and higher lows. Six gaps in 16 days makes it pretty much impossible to play swing reversals within this range. The only way to profit would be to buy near support and sell near resistance. Here we are again. The swing is down after yesterday's gap below 110, but SPY is trading near support around 109-109.5. This is the point where individual trading style and preferences come into play. Bottom pickers see a low risk opportunity near support. Short-term reversal players see a downswing as long as resistance at 111 holds.