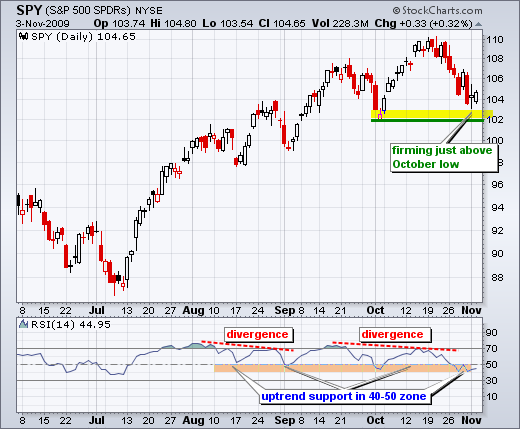

Objectively speaking, the medium-term uptrend in SPY remains in place. The ETF forged a higher high in October and has yet to break the early October low. After a sharp decline from 110 to 104, SPY firmed with a spinning top on Monday and a small white candlestick on Tuesday. This is a good spot for an oversold bounce to materialize. The bottom indicator window shows 14-day RSI in the 40-50 zone. Notice how this zone acted as support in mid August, early September and early October. Will it hold a fourth time? As Yogi would say, "it ain't broken until its broken". Should SPY break the October low and RSI break below 40, it would signal the start of a medium-term downtrend. Therefore, the medium-term trend is up until these events occur.

There is no real change on the 30-minute chart. SPY remains within a falling price channel with lower lows and lower highs since October 21st. In addition, CCI plunged below -100 on October 21st and has yet to surge above +100 to signal a bullish momentum reversal. I am looking for a break above short-term resistance at 105.5 and a CCI surge above +100 to reverse this downtrend. I would not take any signals that occur before 3PM today. There is usually volatility just before and after the Fed announcement (at 2:15). It is important to let the dust settle. Holding positions with a profit buffer is one thing, but initiating new trades ahead of the FOMC policy statement is risky business. In addition Fed volatility today, we also have Initial Claims on Thursday at 8:30AM and the Employment Report at 8:30AM on Friday.