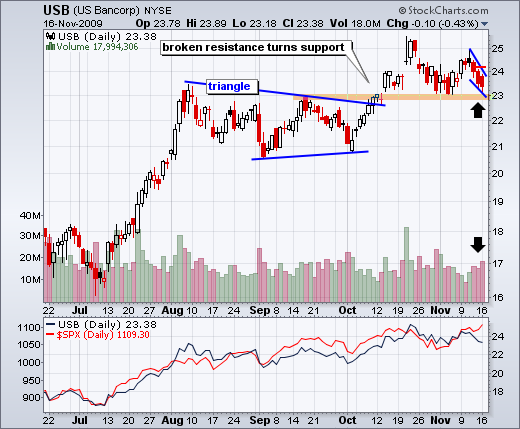

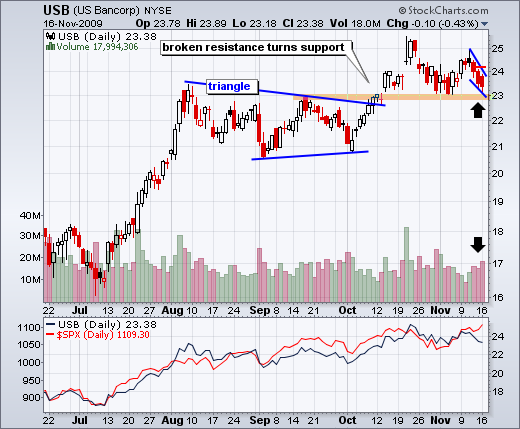

US Bancorp (USB) broke triangle resistance in mid October and broken resistance turned into support around 23. Even though the breakout is still holding, relative weakness in November is a concern here. SPY is up over 7% this month, but USB is down slightly. Moreover, the stock declined with pretty good volume the last three days. Further weakness below 23 would negate the mid October breakout. A small falling wedge defines the three day downtrend. Look for a break above 24.1 to revive the bulls here.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More