Based on the November 16th close, Fluor (FLR) was featured after the stock bounced on good volume. Even though FLR was still in a downtrend, it was at retracement support and the bounce occurred on good volume. This bounce has now failed. First, follow through was weak the next two days. Second, FLR opened strong and closed weak on Monday. The S&P 500 was up over 1% on Monday, but FLR actually closed down on the day. This was a sign of weakness.

The third and final straw occurred on Tuesday when the stock closed weak on above average volume. The medium-term downtrend is proving too strong right now.

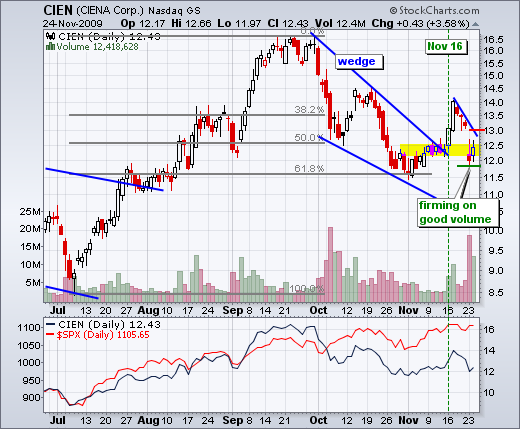

Based on the November 16th close, Ciena (CIEN) was also featured after a high volume wedge breakout. The stock followed through with a close above 14 on good volume the next day and then stalled for a few days. Ciena announced on Monday that it was buying some Nortel assets for $769 million. This caused the stock to gap down and close at 12. While the gap down and high volume decline are technically negative, it was news related and the stock managed to firm in the breakout zone. Moreover, CIEN bounced with good volume on Tuesday. There are now two levels to watch. First, a break below Monday's low would signal weakness and project lower prices ahead. Second, a break above 13 would fill the gap and show resilience.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More