- Charts Worth Watching: CAKE, INTU, JCP, LEAP, MCD, PII, PSS, QSII

- Link to today's video.

- The next update will be Tuesday (July 21) by 7AM ET.

*****************************************************************

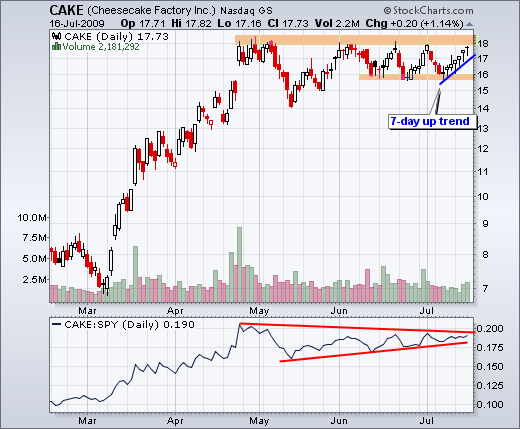

Cake edges towards resistance. With the market surge over the last four days, I would have expected bigger things from the Cheesecake Factory (CAKE). The stock did manage to advance the last seven days, but each advance was small and lacked conviction. Notice how these candlesticks have small bodies that denote little movement from open to close. Overall, the stock remains range bound with resistance around 18 and support around 16. A 7-day uptrend has emerged with the first support at 17.

*****************************************************************

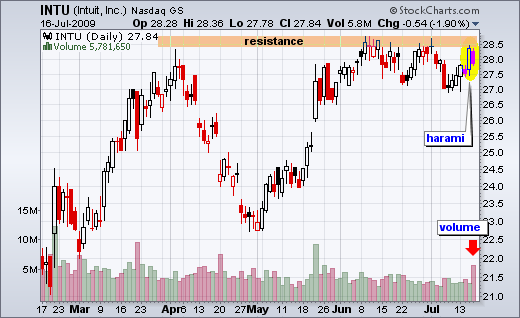

Intuit forms harami at resistance. Intuit (INTU) is part of the technology sector and the software industry. The stock met resistance around 28.5-29 in June and again in July. In fact, INTU gapped down from resistance in early July. The stock surged back to resistance on Wednesday, but volume was low and unconvincing. Yesterday's decline saw volume expand as a harami formed (inside day). Further weakness below 27.4 would confirm this bearish candlestick reversal pattern.

*****************************************************************

JC Penney bounces on low volume. JC Penney (JCP) staved off a support break with a bounce back above 28 this week. The move occurred over the last four day with relatively low volume. I am not impressed as the stock runs into triangle resistance.

*****************************************************************

Leap Wireless may need to change its name to Fall Wireless. The stock plunged in early June, stalled and then plunged again in early July. A flag formed over the last eight days and a break below flag support would signal yet another continuation lower.

*****************************************************************

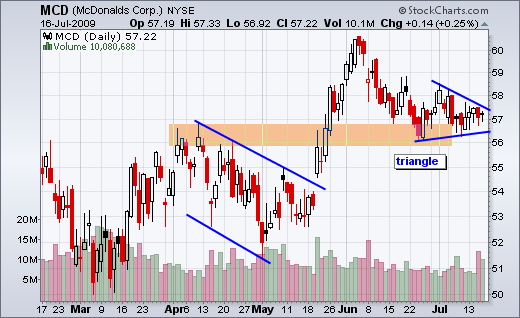

McDonalds stalls at support. Mickey D's (MCD) was conspicuously absent from the surge over the last four days and this shows some relative weakness. A triangle formed from late June and I am watching these boundaries for a break.

*****************************************************************

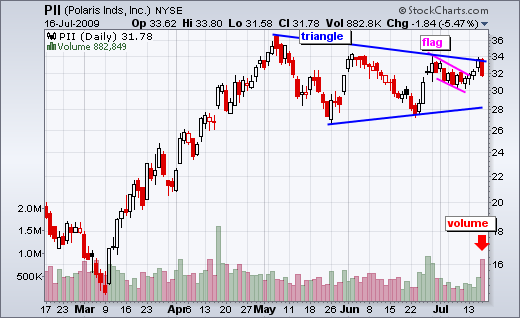

Polaris fails at resistance. I highlighted PII on Tuesday with a flag breakout. The market obliged with a surge higher this week, but Polaris fell on high volume Thursday. Moreover, this decline occurred at resistance. A small pullback on light volume is ok, but a sharp decline on high volume is not.

*****************************************************************

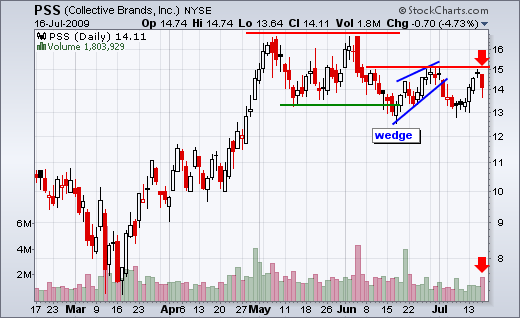

Collective Brands reverses at resistance. After breaking below its May low in mid June, the stock bounced to 15 with a rising wedge. It looked like a continuation lower was signaled with the wedge break, but PSS bounced with the market early this week. However, the bounce fizzled with a doji on Wednesday and high volume decline on Thursday. Also notice that this reversal occurred at resistance.

*****************************************************************

Quality Systems forms bearish wedge. I was not impressed with the bounce in QSII this week. While the market surged over the last four days, QSII was pretty much flat and showed relative weakness. Notice the trendline break in the price relative (QSII:SPX ratio). A small wedge formed after the sharp decline in early July. Look for a break below yesterday's low to signal a continuation lower.

*****************************************************************